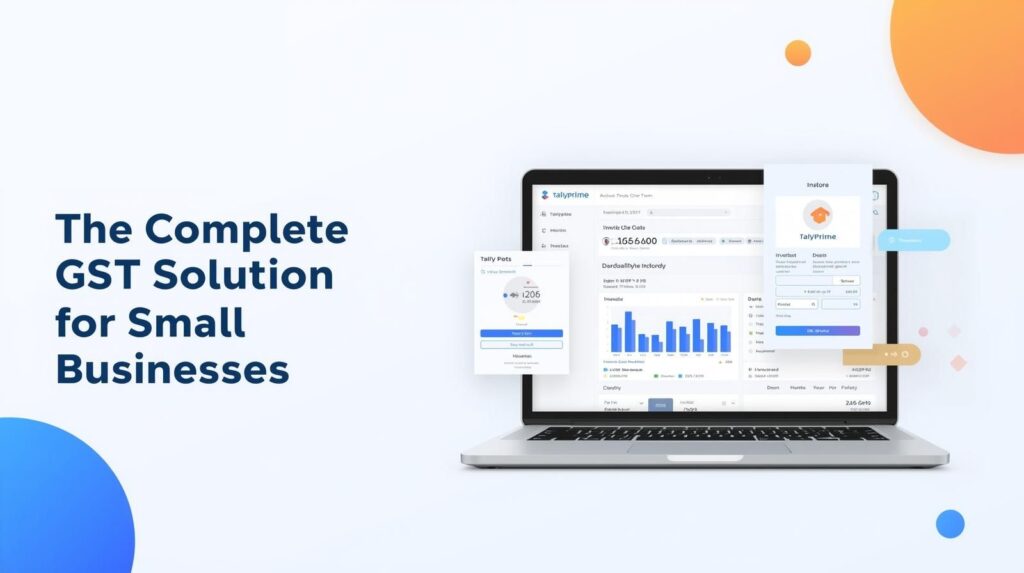

TallyPrime is a powerful accounting and business management software that helps small businesses in India achieve seamless GST compliance. With the rapidly evolving GST landscape, staying up to date with changing rules, invoicing mandates, and strict return deadlines is critical for every business owner. TallyPrime provides a robust solution that streamlines GST invoicing, automates return filing, reduces compliance errors, and offers vital insights to keep businesses penalty-free and audit-ready.

TallyPrime streamlines GST implementation for small businesses with a user-friendly GST setup process. The software guides users through the configuration of GST, including registration details, applicable tax rates (CGST, SGST, IGST), and product-specific tax categories. This guided process ensures GST rules are accurately set up, eliminating configuration errors from the start and saving time for business owners.

One of the core strengths of TallyPrime is its ability to generate 100% GST-compliant invoices. The platform automates bill generation by pre-filling invoice fields with HSN/SAC codes, customer GSTINs, and auto-calculated tax rates. This not only prevents manual errors but also ensures every invoice meets the regulatory guidelines, thus avoiding penalties for non-compliance. Users can also customize invoices for branding while maintaining compliance with government requirements.

TallyPrime’s GST module simplifies the most challenging aspect for small businesses—return filing. It auto-generates GSTR-1, GSTR-3B, and other returns directly from transaction records. Users can preview, validate, and correct data before uploading returns to the GSTN portal, significantly reducing mistakes and late fees. Automated status trackers help businesses know when actions are needed, while digital mark-as-signed features let users track returns already filed versus pending amendments.

Mistakes in return filing or mismatches with supplier records often lead to loss of admissible Input Tax Credit (ITC). TallyPrime addresses this issue with its advanced GST reconciliation tools. The software automatically compares purchase data with GSTR-2A (supplier filings), identifying mismatches and helping users correct claims on time. All eligible ITC is tracked, ensuring businesses never miss an input credit, which directly improves cash flow.

As e-invoicing becomes mandatory for more businesses, TallyPrime natively integrates e-invoicing into its core features. The software auto-generates JSON files, uploads them to the GSTN portal, and retrieves IRNs and QR codes—fulfilling all statutory e-invoice requirements. E-way bill integration also enables direct generation and tracking of transport documents for goods movement, reducing logistics bottlenecks and compliance risks.

For growing small businesses with operations in multiple states or branches, TallyPrime effortlessly manages multiple GSTINs. The software handles state-specific rules, tax rates, and consolidates reports for each location. Multi-currency support is also available, simplifying GST compliance in cross-border transactions or exports.

TallyPrime provides live reports on GST liabilities, ITC utilization, pending payables, and compliance status at any time. Dashboard insights and automated alerts highlight critical deadlines for return filing, tax payments, and reconciliation steps, so nothing falls through the cracks. These reporting tools empower small businesses to make data-driven decisions while staying fully compliant.

Inbuilt error-detection features automatically highlight inconsistencies in GST entries, invoice mismatches, or missing details before submitting returns. This proactive correction process dramatically lowers the risk of GST scrutiny, penalties, or audits. All GST records are securely maintained in prescribed formats, facilitating effortless compliance verification during audits.

Sensitive GST and financial data is protected by strong encryption and customizable user roles. TallyPrime’s data security features allow business owners to restrict permissions for staff, ensuring only authorized personnel can view or modify GST data. Daily data backups further reduce the risk of data loss during compliance operations.

Small business teams benefit from TallyPrime’s intuitive dashboards and multi-user access. GST tasks can be distributed among team members, with comprehensive audit trails for every action taken. This collaborative approach speeds up return preparation, data reconciliation, and approval workflows.

Feature | Benefit for Small Businesses |

Automated GST Invoice Generation | Reduces manual errors and speeds invoicing |

GST Return Filing Integration | Direct upload to GSTN portal for timely filing |

Real-Time GST & ITC Reports | Immediate insights for cash flow management |

Automated GSTIN/HSN Detection | Ensures correct rates and eliminates guesswork |

E-Invoicing & E-Way Bill Integration | Compliance with new mandates in one place |

Error Detection & Compliance Alerts | Prevents costly mistakes and audit notices |

Multi-GSTIN & Multi-State Handling | Simplifies pan-India and export transactions |

Strong Data Security | Keeps financial and GST data safe |

TallyPrime gives small businesses a strong edge in GST compliance by automating calculations, eliminating filing errors, managing credits, and anticipating changes in GST rules. With integrated e-invoicing, reconciliation tools, multi-state management, and preventive error detection, business owners can be confident of accurate, timely, and hassle-free GST compliance every month. Choosing TallyPrime is more than adopting a software—it’s investing in peace of mind, making business growth and compliance easy, efficient, and future-proof.

4.9 google Reviews

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.