From Startup to Enterprise: How Tally Adapts to Every Stage of Business Growth

From Startup to Enterprise: How Tally Adapts to Every Stage of Business Growth In today’s fast-paced business environment, one truth remains constant: growth is the ultimate goal. Whether you’re a small startup, a scaling SME, or a well-established enterprise, your financial and operational needs evolve as you grow. The challenge is finding a solution that […]

The Role of Tally in Sustainable Business Growth: Digital Accounting for a Greener Future

The Role of Tally in Sustainable Business Growth: Digital Accounting for a Greener Future Introduction – Why Sustainability and Business Growth Go Hand in Hand In today’s competitive economy, business growth and sustainability are no longer separate conversations. Companies across the world, especially in India, are realizing that long-term success isn’t just about revenue; it’s […]

Tally Prime vs Traditional Accounting Methods in 2025: Why Automation Wins

Tally Prime vs Traditional Accounting Methods in 2025: Why Automation Wins In 2025, small and medium enterprises (SMEs) in India stand at a critical crossroads: continue with manual bookkeeping and traditional spreadsheets, or embrace modern accounting automation. The debate of Tally Prime vs traditional accounting methods in 2025 is not just about tools—it’s about survival, […]

From Compliance to Growth: How Tally Customization Powers Industry-Specific Success

From Compliance to Growth: How Tally Customization Powers Industry-Specific Success In today’s competitive business environment, companies across India are no longer satisfied with merely staying compliant. They want tools that help them grow, scale, and dominate their industries. That’s where Tally customization for industry-specific business growth comes into the picture. Tally Prime, India’s most trusted […]

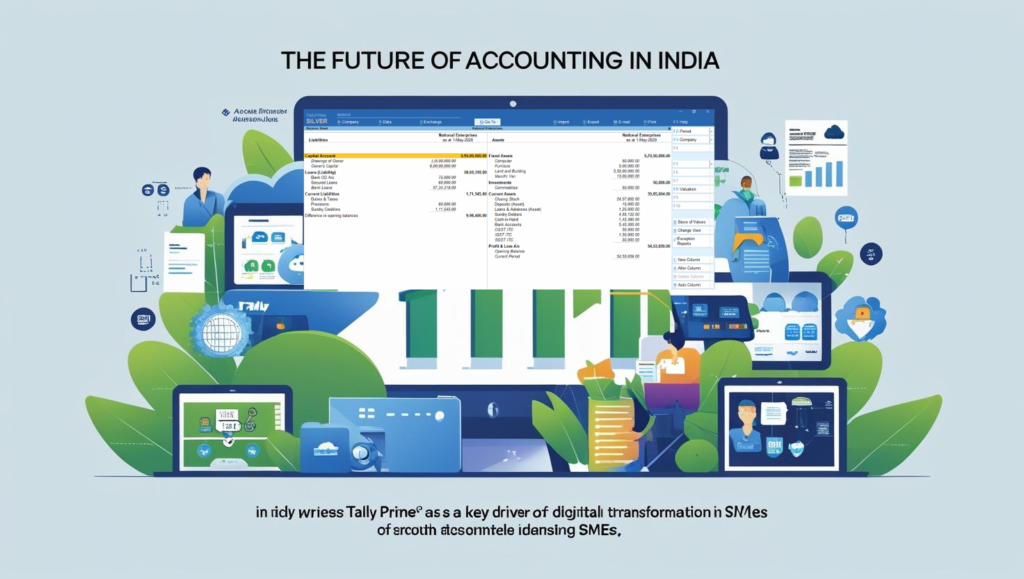

The Future of Accounting in India: How Tally Prime is Driving Digital Transformation for SMEs

The Future of Accounting in India: How Tally Prime is Driving Digital Transformation for SMEs In India’s fast-evolving business environment, small and medium enterprises (SMEs) form the backbone of the economy. However, with rapid digitization, regulatory changes like GST and e-invoicing, and the growing need for financial accuracy, traditional accounting methods are no longer enough. […]

Customized Tally Solutions for Every Industry: A Deep Dive into Retail, Manufacturing, and Service Sectors

Customized Tally Solutions for Every Industry: A Deep Dive into Retail, Manufacturing, and Service Sectors In today’s business landscape, one-size-fits-all ERP systems simply don’t work. Every industry has unique challenges—whether it’s a retail store managing fast-moving inventory, a manufacturing company monitoring job costing, or a service provider handling payroll and recurring invoices. This is where […]

How Tally Prime Empowers Startups to Manage Finances Smartly from Day One

How Tally Prime Empowers Startups to Manage Finances Smartly from Day One Starting a new business is exciting, but it also comes with one of the toughest challenges: managing finances effectively right from day one. For startups, cash flow, compliance, accounting, and resource planning are often make-or-break factors. This is where Tally Prime for startups […]

The Hidden Features of Tally Prime Every Business Owner Should Know

The Hidden Features of Tally Prime Every Business Owner Should Know When it comes to business accounting and ERP software, Tally Prime stands out as a reliable and powerful tool. Most business owners are familiar with its basic functions—recording transactions, generating invoices, and creating financial reports. But beyond these common tasks lies a treasure trove […]

How Tally Prime Helps Businesses Reduce Manual Errors and Improve Accuracy

How Tally Prime Helps Businesses Reduce Manual Errors and Improve Accuracy In the fast-paced business world, even the smallest accounting mistakes can lead to significant financial and compliance issues. From mismatched invoices to incorrect GST filings, manual errors in bookkeeping cost businesses not only money but also time and reputation. This is where Tally Prime […]

Why Choosing a Tally 5-Star Certified Partner Matters for Your Business Success

Why Choosing a Tally 5-Star Certified Partner Matters for Your Business Success In today’s digital-first business environment, having a reliable financial management system is no longer optional — it’s critical. Tally, one of the most trusted accounting software solutions in India, plays a crucial role in helping businesses maintain GST compliance, manage inventory, and streamline […]