India E-Invoicing Update 2026 | Rules Explained

India E-Invoicing Update 2026 | Rules Explained E-Invoicing — short for electronic invoicing — is not simply sending an invoice by email. Under India’s GST framework, e-invoicing refers to a standardised system where B2B (business-to-business) invoices are digitally authenticated by the government-designated Invoice Registration Portal (IRP) before they are shared with buyers or reported to the GST Network (GSTN). Since […]

Tally ERP 9 vs TallyPrime 7.0: Key Differences Explained

Tally ERP 9 vs TallyPrime 7.0: Key Differences Explained In the ever-evolving landscape of accounting software, Tally ERP 9 vs TallyPrime 7.0 has become a hot topic among Indian SMEs. As businesses strive for efficiency, understanding the differences between these two versions is crucial. This article will delve into the latest updates, features, and key differences that […]

Bare Metal Server: Complete Guide to Performance & Benefits

Bare Metal Server: Complete Guide to Performance & Benefits What is a Bare Metal Server? A Bare Metal Server is a physical server dedicated to a single tenant, providing high performance and complete control over the hardware. Unlike virtual servers, which share resources among multiple users, bare metal servers are not virtualized. This means that all the […]

Mastering Multi-Branch Accounting for Indian Businesses

Mastering Multi-Branch Accounting for Indian Businesses Managing multi-branch accounting in India can be a complex task for many businesses, especially as they expand their operations across various locations. With the rise of digital solutions and the increasing need for compliance with regulations such as GST, it is essential for Indian SMEs to adopt effective strategies that streamline […]

Tally 7.0 Release: Key Features & Updates

Tally 7.0 Release: Key Features & Updates The Tally 7.0 Release has generated significant interest among Indian SMEs, especially with its enhanced features tailored for compliance and automation. As of 2026, TallyPrime 7.0 has been adopted by over 70% of Indian SMEs, reflecting its critical role in streamlining accounting processes and ensuring GST compliance. This article will […]

Enterprise Cloud Strategy 2026: Complete Guide By Cevious

Enterprise Cloud Strategy 2026: Complete Guide By Cevious In today’s rapidly evolving digital landscape, developing a robust enterprise cloud strategy has become crucial for business success. As we navigate through 2026, organizations must adapt to new technological paradigms while ensuring scalability, security, and cost-effectiveness. This comprehensive guide explores the latest approaches to cloud infrastructure and how businesses […]

Tally Prime Server: Complete Guide for Businesses

Tally Prime Server: Complete Guide for Businesses If your business runs on Tally and multiple users access the same data daily, you’ve likely faced slow loading, data conflicts, or backup risks. For growing companies, CA firms, manufacturers, and enterprises, basic multi-user setups eventually hit performance and control limits. That’s where Tally Prime Server becomes critical. This guide […]

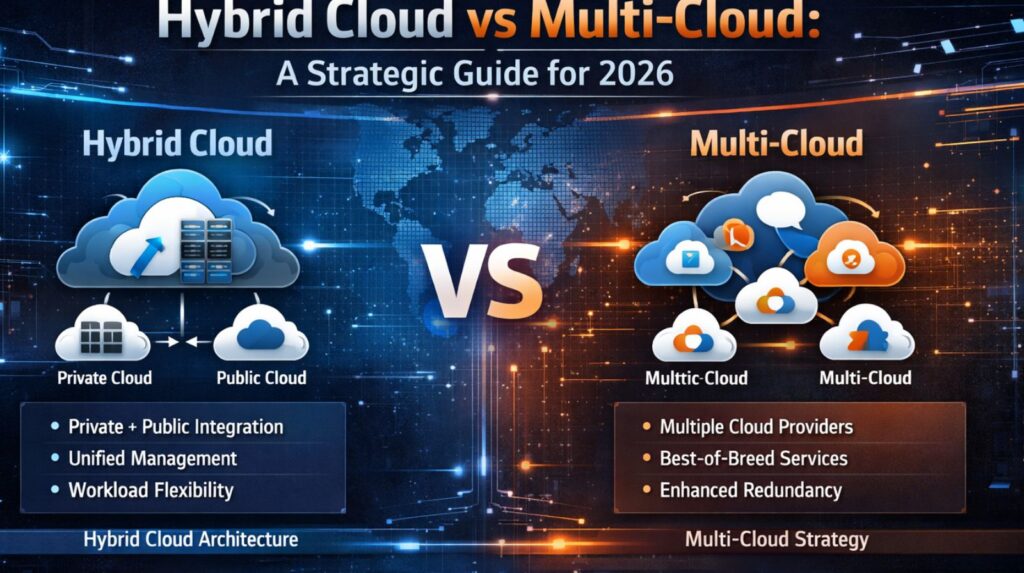

Hybrid Cloud vs Multi-Cloud: A Strategic Guide for 2026

Hybrid Cloud vs Multi-Cloud: A Strategic Guide for 2026 In today’s rapidly evolving enterprise technology landscape, the debate between hybrid cloud vs multi-cloud strategies continues to shape IT infrastructure decisions. As we navigate through 2026, organizations face increasingly complex choices in their cloud adoption journey, requiring a thorough understanding of both approaches to make informed decisions. Understanding […]

Cloud Adoption in 2026: Strategy, Security & Blueprint Guide

Cloud Adoption in 2026: Strategy, Security & Blueprint Guide The landscape of technology is evolving rapidly, and cloud adoption in 2026 is set to redefine how businesses operate. As organizations increasingly recognize the benefits of cloud computing, understanding the strategies, security measures, and blueprints for successful adoption becomes crucial. This guide will explore the essential elements of […]

High Cost Server Low Performance: 7 Major Fixes (2026)

High Cost Server Low Performance: 7 Major Fixes (2026) In today’s competitive business landscape, dealing with high cost server low performance issues has become a critical challenge for IT managers and business leaders. Organizations frequently find themselves investing substantial resources in server infrastructure while experiencing suboptimal returns. This comprehensive guide explores the root causes and provides actionable […]