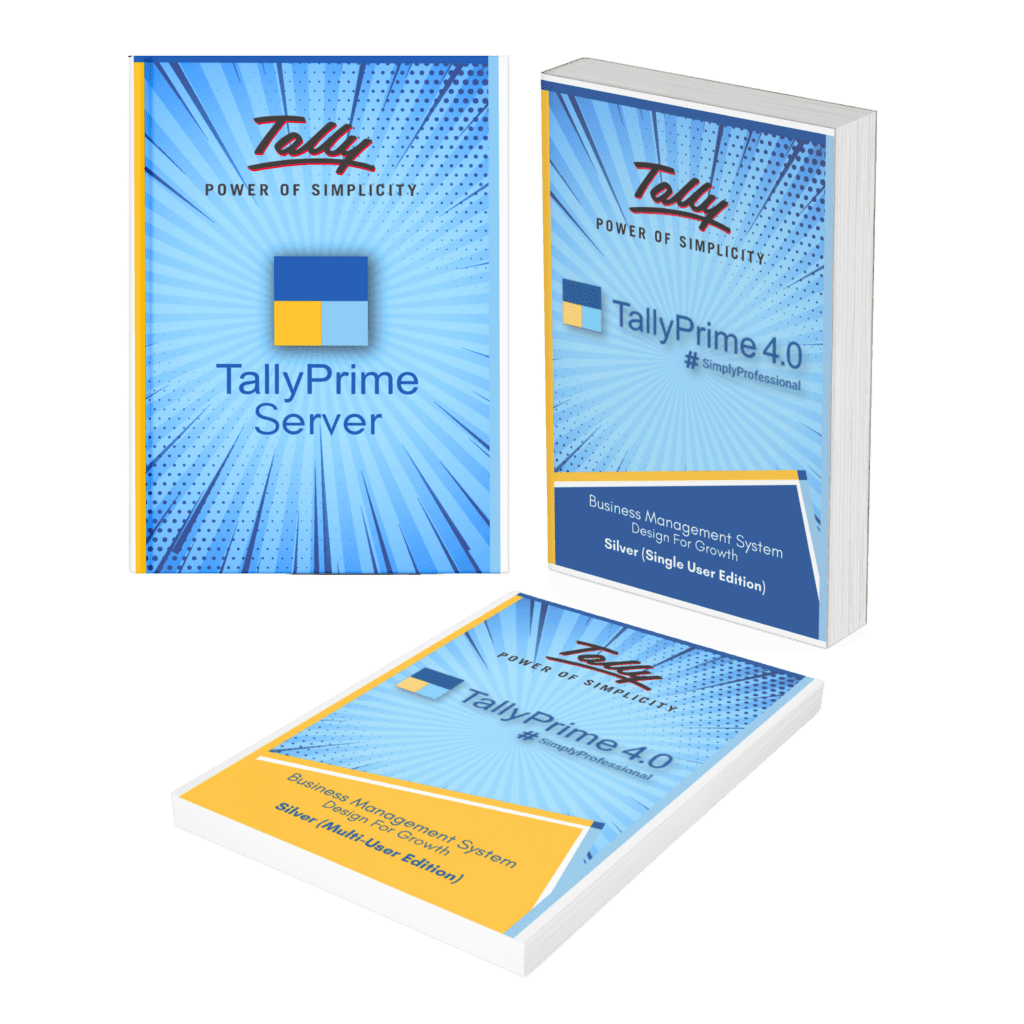

- Product

product

- Services

Services

- Data Center

Cloud DC

Tally on Cloud simplifies accounting, accessible anytime and anywhere, enhancing flexibility and convenience for users.Choose a secure backup solution with strong encryption, flexibility in scheduling, and easy data restoration.

Tally on Cloud simplifies accounting, accessible anytime and anywhere, enhancing flexibility and convenience for users.Choose a secure backup solution with strong encryption, flexibility in scheduling, and easy data restoration.Enterprises Cloud

A collection of security measures designed to protect cloud-based infrastructure, applications, and data. - DevelopmentTransform Your Online Store with Custom Ecommerce SolutionsEnhance Customer Relationships with Tailored CRM Systems

ApI Integrations

Seamlessly Connect Systems with Robust API Integration ServicesInnovative Software Solutions for Your Unique Business Needs - Resourses

- Contact Us