It is difficult to determine invoices that haven’t been supplied from the vendor?

It is difficult to track down invoices that do not match to GSTR-2B/2A?

Do you have a difficult time keeping track of invoices that have been uploaded over different time frames for return? The list of possible issues could continue for a long time ….

No worries! Download the most current TallyPrime version for making GSTR-2A/GSTR2B reconciliation quick and simple task.

| 5 New capabilities of TallyPrime which makes it simpler to handle GST Compliance for your Business | GSTR-2B Ease and GSTR-2A Reconciliation TallyPrime |

GSTR-2A reconciliation and GSTR-2B reconciliation in TallyPrime

Simply import the GSTR-2B/2A report and allow TallyPrime complete the rest. TallyPrime will automatically reconcile your transactions and provide you with an instant and thorough overview of reconciled transactions as well as the ones that don’t match. The most appealing aspect is that the reconciled transactions are categorized in various categories, helping you identify the root cause and take appropriate actions to fix them.

TallyPrime’s GST reconciliation capabilities

Enjoy greater comfort in the reconciliation process with the capability to reconcile data for different return times.

Let’s take a look at the ways that TallyPrime can make GST reconciliation much easier.

GSTR-2B and GSTR-2A reconciliation

GST reconciling in TallyPrime is so easy to do when you upload the GSTR2B/2A accounts The books’ information will be automatically reconciled to the statement, and provide a quick and comprehensive report of reconciled transactions and any inconsistencies. It’s so quick that in just only a couple of clicks, you will have a complete overview of the reconciled invoices as well as those which aren’t matching.

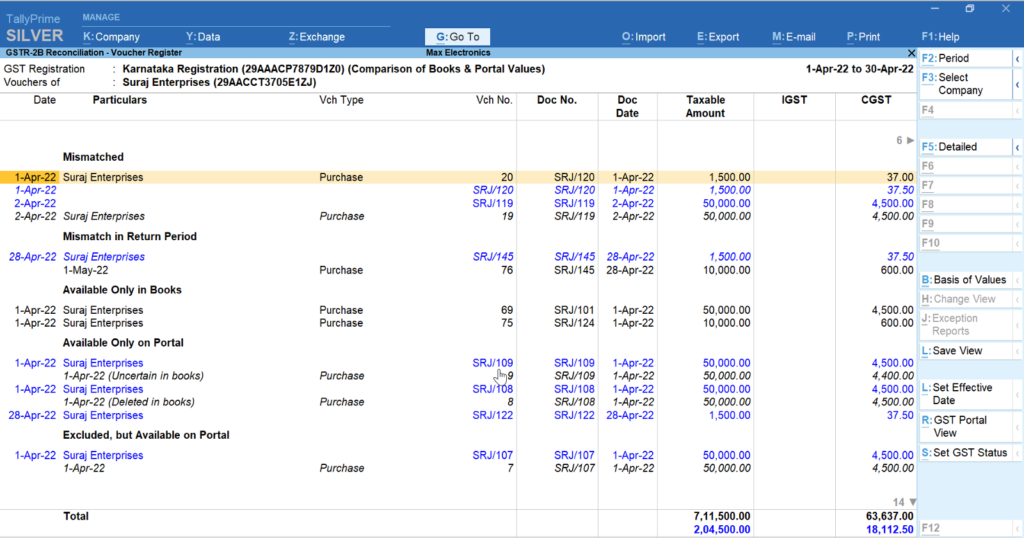

Recognize transactions that are not reconcilable.

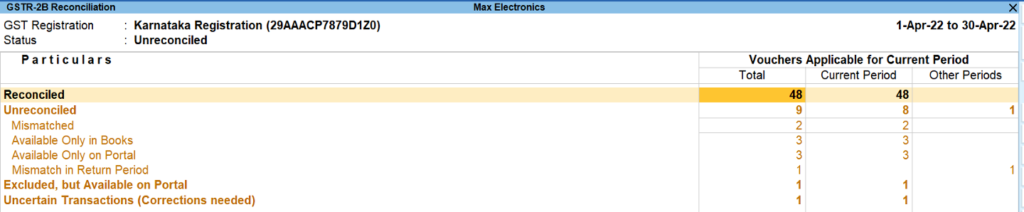

The unreconciled transactions will be identified in various categories. This helps in identifying the cause of errors and enables users to take the appropriate steps to fix the issue.

Find invoices that have not been supplied by your supplier

Learn about the invoices that have not been submitted from your vendors, have not been recorded in your books, are not in the correct return time, and all these instances of invoices that are not reconciled aiding in the calculation of credits for input taxes.

Track invoices that do not match during the period of return

Sometimes, there may be a mismatch between dates of transactions as a result, it may show up in different returns for you and the other party. In these cases it is possible to simply alter the “GST Return Effective Day” in your accounts to reflect within the relevant return period.

Summary of Reconciliation status

The reconciliation statistics section provides an overview of the total number reconciliations that have been reconciled as well as unreconcilable and unconciled transactions. It is possible to drill down into each section to look more closely at the details of the transaction.

Probable matches

Although you’ve taken every precaution when recording your GST information, there are times when your transactions might not be reconciled due to small differences in specifics like the Section number, GSTIN or the Doc Number. TallyPrime’s reconciliation tool is intelligent enough to detect such positional errors and is grouped into separate and allows you to make the necessary adjustments to reconcile the transactions.

Multi-GSTIN Support

If you have multiple GST registrations/GSTINs, the GSTR-2A/2B reconciliation report provides an amazing view of your combined GST details and activities across registrations. You can look at the GSTR-2A/2B reconciliation report for an each registration in any of your branches and companies. You can review and decide on your ambiguous operations for each of your GSTINs in combination or for just the one GSTIN at a given time, according to your specific business requirements.

Simple, intuitive design of reconciliation reports

This GSTR-2B as well as GSTR-2A reconciliation report is so straightforward that you can get an all-encompassing view of reconciliation processes in only a few minutes. The pending actions or those which require actions are highlighted in an amber colors, while portal values are displayed in blue for quick identification. Additionally, the structure of the report is designed to resemble the look of a portal, which means it’s easy to understand and understand.

How can I reconcile GSTR-2B and GSTR-2A in TallyPrime

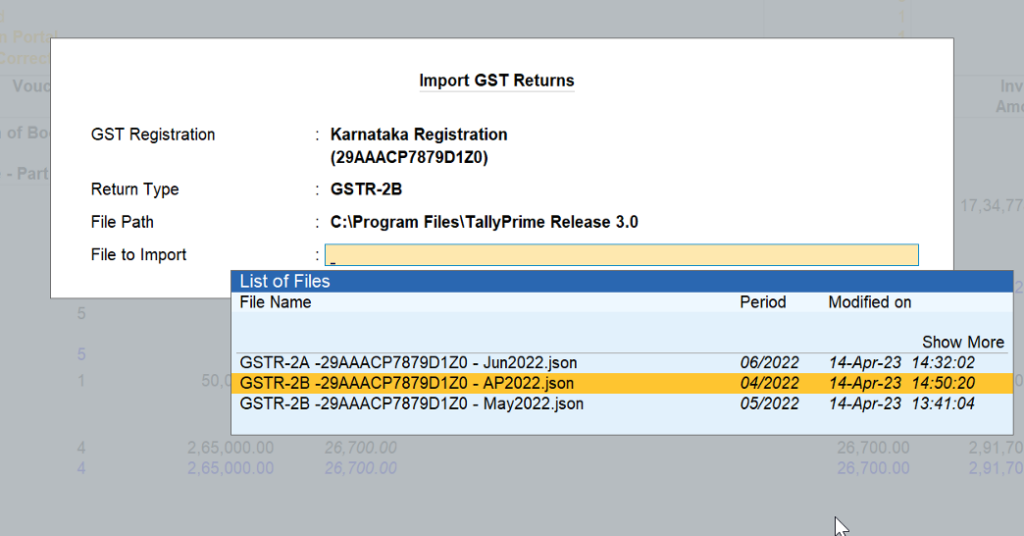

Conciliating GSTR-2B and GSTR-2A as simple as 123… You just have to download the tax declaration through the GST portal and then import it in TallyPrime. That’s it! The most recent TallyPrime Version will be able to automatically reconcile, and then flag the ones that have not been reconciled based on reasons.

Here are a few steps in reconciling GST in TallyPrime

- GSTR-2B/2A import statement in TallyPrime

- TallyPrime can automatically reconcile books to the statement.

- Invoices that are in agreement will be reconciled, while the remainder will be marked as not reconciled.

- A quick summary is provided to view the current status (reconciled or mismatched, etc.)

- Explore the invoices that are not reconciled with their reasons and take appropriate actions.

There’s more in TallyPrime’s newest version

In addition to the features mentioned above In addition, the latest version of TallyPrime comes loaded with a variety of additional tools to help you manage your compliance and meet business requirements.