Oops! I didn’t make the payment as that it was due in 45 credit days, however it was meant to be paid within 15 days. I waited for the payment to be paid however, I later discovered that my provider is a micro-business that is registered under MSMED Act.

If you’re working MSMEs, we’re sure that you’ve encountered these issues.

A lot of businesses that transact with small and micro companies often mix up the 15-day and 45-day and the actual credit period, and miss payment deadlines. It’s not because businesses are trying to delay payments but, more often it’s because they are unable to keep track of MSME payments with the relevant information like due dates and due dates. in accordance with MSME payment rules. This is even more complicated due to the variety of the suppliers you deal with.

In the present, TallyPrime comes with powerful enhancements that can help to make your payment processing in line with the MSME rules, specifically dealing with the most recent section 43b(h) that imposes the exclusion of expenses associated with overdue invoices and thereby providing improved conformity measures.

Let’s take a look at the ways TallyPrime can help you to manage MSME payments with ease.

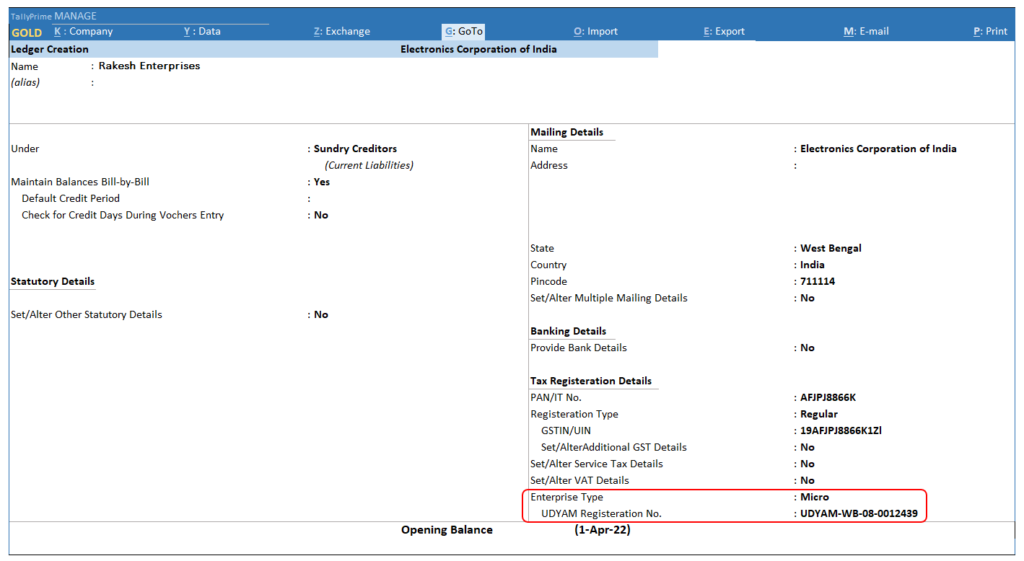

The identification of MSME parties using TallyPrime 4.1

The most recent release of TallyPrime adds an MSME feature that dramatically simplifies how businesses regardless of size manage their suppliers and categorize them especially those that are classified as MSMEs. In recognition of the different compliance requirements for different kinds of businesses, the latest release facilitates the effective updating and monitoring of UDYAM registration numbers, and categorizes companies as Micro, Small or Medium.

The business can input these details to every supplier ledger, or in bulk using updated Party MSME details or Excel spreadsheets.

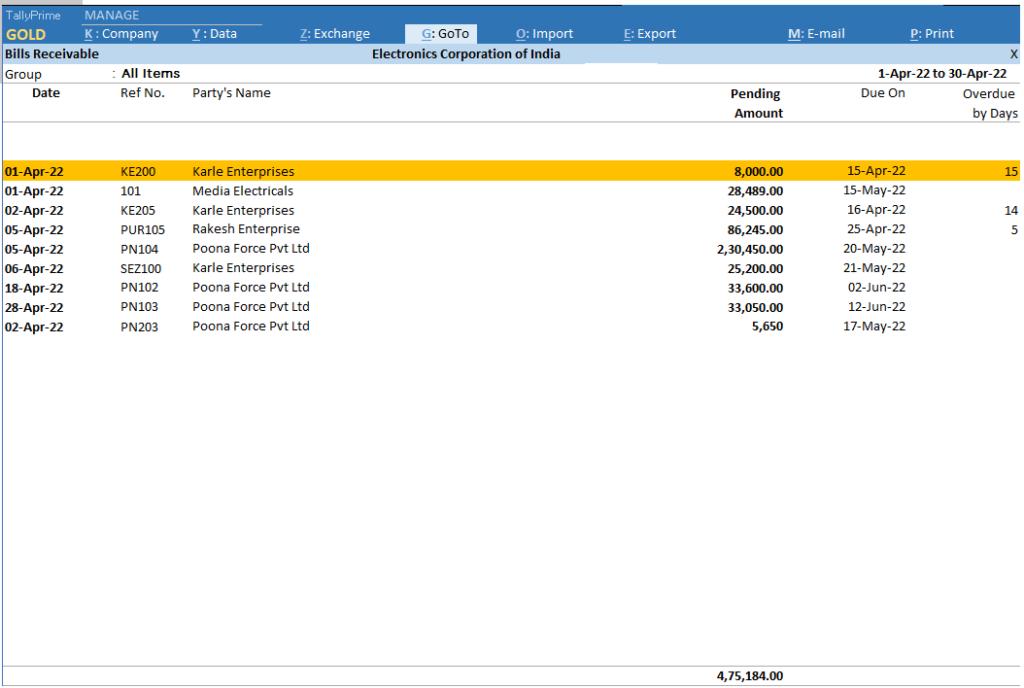

Access to bills that are in arrears

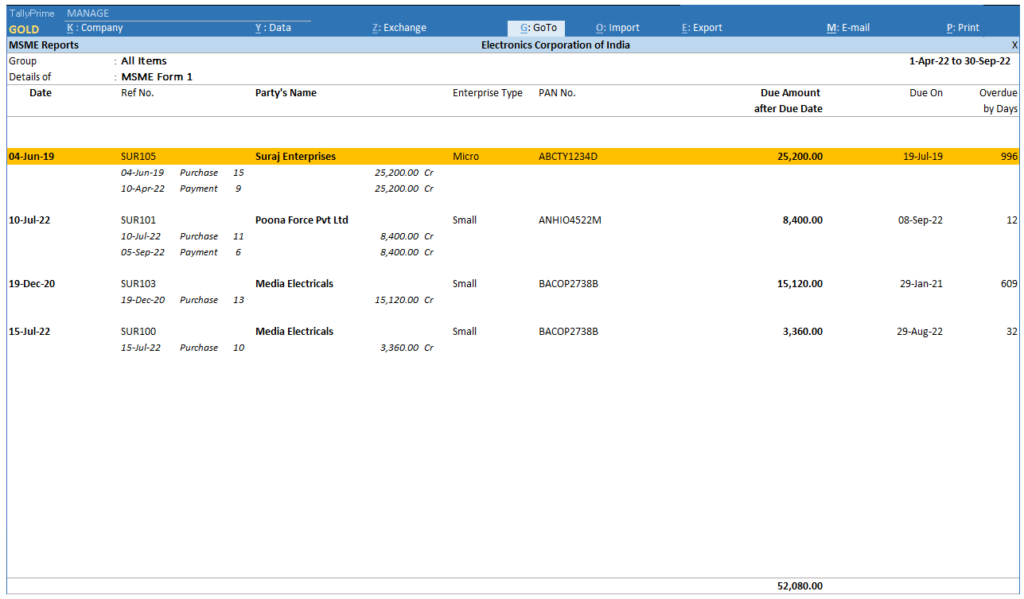

With the release of TallyPrime it is now possible to track the payments for MSME suppliers, with an in-depth segregation of Small and Micro companies. You can easily identify due dates for MSMEs’ payments and those that are due. The greatest benefit is that you can keep track of the upcoming due dates in accordance with the MSME payment rules, i.e. the 45-day and 15-day rules or the date you have agreed to.

This feature does not only provide an exhaustive view of charges due but also helps in the management of payments within agreed times.

MSME form 1 reporting

It is easy to access bills that are due and easily report them on MSME Form 1 which saves precious time and energy for business.

The MSME Development Act 2006, strengthens the protections of MSMEs against payment delays by establishing the maximum credit period for each in addition to penalizing the lateness of payments. Businesses must provide explanations for any payment problems within their financial accounts. If a loan to an MSME is due for over 45 days they are required to file MSME-1 form, describing the cause of the delay.

| Inventory Forecasting for Small Businesses | Navigating Supply Chain Disruptions: Strategies for Resilience in Uncertain Times |

It is a method to simplify the auditing process of CAs.

With the vital information about MSME classification the auditing process for Chartered Accountants (CAs) is simpler. This data accessibility means that audits of financial compliance and compliance can be completed efficiently and without the need for lengthy information gathering and verification procedures.

Facilitating compliance with section 43b(h)

Another important aspect that is a major feature of The TallyPrime 4.1 is its capacity to assist companies in complying in accordance with Section 43b(h) which relates to the non-allowance of costs incurred on late bills. The program allows users to identify the bills that have passed their due date in the financial year, but are not paid, and thereby helping to take the appropriate steps to ensure compliance and avoid possible penalties.

Conclusion

Introduction of MSME payment compliance simplifies compliance and payment processes for companies. Through providing tools to facilitate the identification of MSME suppliers, easing processes for the CA auditoring procedure, providing fast access to bill payments that are overdue and aiding in complying with the applicable legal regulations, TallyPrime ensures that businesses can concentrate on growing instead of focusing on administration tasks. This release is a testament to Tally’s determination to improve efficiency in business operations while also supporting an essential ecosystem that includes MSME suppliers.