Do you have a regular business that involves trading, manufacturing, reselling, or providing services? GSTR-1 reconciliation is something you should not overlook. Here are some benefits that your business can get from GSTR-1 reconciliation.

It is good to reconcile return data, especially when it is filed by an employee at a different branch or a third party like an auditor or chartered account. You can then compare the data from the portal to the data stored in your company’s books, and determine any discrepancies.

It might seem impossible to keep track of all the GST differences, given the number and variety transactions. You don’t need to worry about reconciling anything if you download the latest version of TallyPrime.

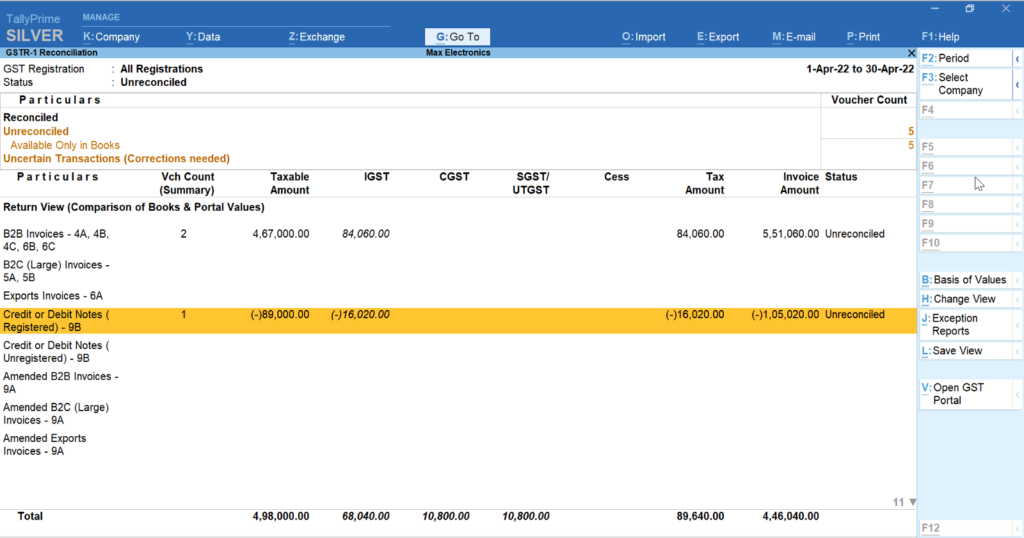

After you import the GSTR-1 data into TallyPrime the relevant details will appear in the GSTR-1 reconciliatory report along with your company’s books. You can then verify the information and make any necessary changes.

What is GSTR-1 reconciliation?

GSTR-1, as we all know, is a statement that lists all supplies made to third parties. It should be filed on a regular basis by registered tax payers and casual taxpayers (depending on their business turnover).

GSTR-1 reconciliation involves the regular matching of your GSTR-1 form with your book of account. This is done to make sure that your returns and books are in sync.

TallyPrime latest version allows seamless GSTR-1 reconciliation

GSTR-1 reconciliation can be overwhelming due to the volume of daily sales transactions. TallyPrime offers a hassle-free solution for GSTR-1 reconciliation, so businesses can stay compliant.

TallyPrime can make your reconciliation process easier:

The assurance of compliance

It can be confusing to understand the different sections and tables in Form GSTR-1. TallyPrime allows businesses to sort GST data without having to do so separately. The GSTR-1 reconciliation is accurately mapped with the GSTR-1 tables and automatically assigns all GST onward supply to the relevant table. The sections will reflect the import of business details.

Design that is intuitive and user-friendly

Finding the transactions you need to pay attention to can be difficult with so many transactions and changes. TallyPrime’s latest version makes it easier to identify transactions that need attention. All sections that are important will be highlighted with amber and values from the portal in blue.

TallyPrime’s flexibility makes it easier to identify reconciled and non-reconciled transaction. All data imported from the portal is moved to a new section called ‘Available only on Portal’.

TallyPrime allows you to set the GST Return Effective date for a particular transaction. You might not have been in a position to upload a particular transaction to the GST portal within the month or you may have agreed to do so with your counterparty. You can update the GST return effective date as necessary for such transactions. These transactions will appear automatically under Mismatch in return period.

Unmatched performance

GST transactions can be overwhelming because of the amount of data. TallyPrime allows you to manage large data sets without any problems. GSTR-1 reconciliation reports are always instantly available. This means that as soon as your GSTR-1 file is imported, all the information from the return will appear in the reports. GSTR-1 reconciliation will quickly load all the details, even if you have hundreds of thousands of GST transactions. TallyPrime also allows you to quickly move between reports, drill down into transactions, and make the reconciliation process more efficient.

Support for multiple GSTINs

If your business consists of multiple GST registrations/GSTINs, then the GSTR-1 Reconciliation report provides you with an amazing view of your combined GST details and activities across registrations. GSTR-1 reconciliation can be viewed for just one registration from any company. Depending on your business practices, you can export your return or view your uncertain transactions. You can also resolve any doubtful transactions.

Additional Flexibilities

GSTR-1 reconciliation report offers you a variety of flexibility. After importing GSTR-1 data you can compare values between your books and the portal or view the difference, according to your preference. Other options include viewing the report of all transactions or specific transactions like Available Only in Books, Excluded but available on Portal. You can choose to ignore any minor differences between the values of your company’s books and portal that may arise due to rounding or other factors.

How to reconcile GSTR-1 with TallyPrime

GSTR-1 reconciliation is easy with TallyPrime’s latest version! Below are the steps that will guide you through the reconciliation process.

You can easily reconcile GSTR-1 using TallyPrime.

- TallyPrime import GSTR-1 statement

- TallyPrime automatically reconciles the books and the statement

- The invoices that match are reconciled. All others will be marked with the reason for not being reconciled.

- You can see the status of your reconciliation (matched, unmatched, etc.).

- Take appropriate action if you find invoices that are not reconciled.

TallyPrime version 5.0 has more features for you.

TallyPrime’s latest version is not only packed with the features mentioned above, but also has a multitude of other features that will help you manage your business and compliance needs.

Read More