TallyPrime Release 3.0 revolutionizes the management of multiple GST registrations in a single company. This version streamlines various processes, from transactions and TDS returns to salary payments and outstanding management, enhancing overall operational efficiency. Businesses benefit from consolidated data at specific intervals, offering a comprehensive overview for informed decision-making.

Moreover, TallyPrime 3.0 empowers users to generate precise GST returns on a GSTIN-wise basis, eliminating the need for external tools. The software provides flexibility in reporting, allowing users to effortlessly view and export GSTR returns with either a single or multiple GSTINs as per their preferences. This adaptability ensures businesses can tailor their reporting to meet specific requirements. Support for exporting JSON files for GSTR returns, whether for single or multiple GSTINs, simplifies the compliance process. TallyPrime’s user-friendly interface ensures accessibility for businesses of all sizes, providing a comprehensive reporting system for gaining insights, tracking GST compliance, and meeting filing requirements accurately and punctually. In essence, TallyPrime Release 3.0 offers an integrated and efficient solution for businesses managing multiple GST registrations within a unified company structure.

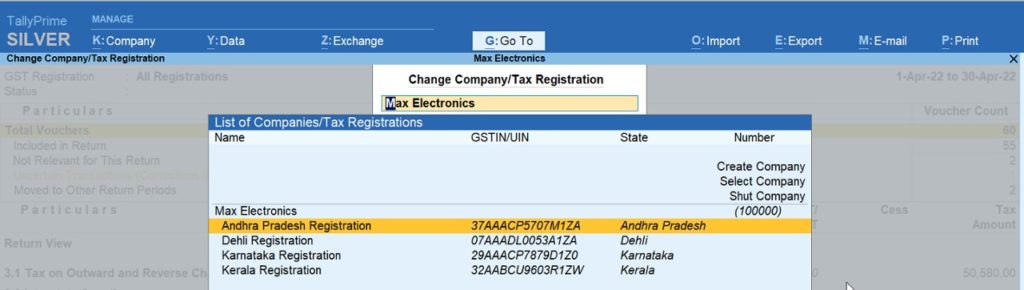

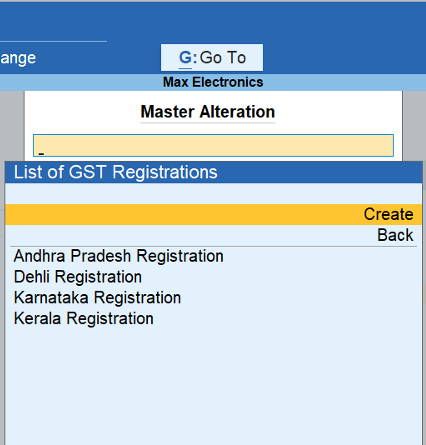

Create & manage multiple GST registration details

TallyPrime 3.0 empowers businesses to effortlessly create and manage multiple GST registrations within a single company. Whether handling branches in different states or operating with separate GSTINs, the software simplifies the setup process. Additionally, it offers the flexibility to mark registration statuses as ‘Active/Inactive,’ streamlining the management of temporary suspensions or the surrendering of GST registrations. TallyPrime 3.0 provides a dynamic and user-friendly solution for businesses navigating the intricacies of multi-GSTIN scenarios.

Easily categorize or identify transactions GSTN-wise

With TallyPrime 3.0 transactions, you can effortlessly categorize and track transactions for your multi-GSTIN company. By assigning applicable rules for each GSTIN, you can easily record transactions without any hassle.

For instance, let’s consider a scenario where you have created three GSTINs – Delhi, Karnataka, and Kerala. With TallyPrime 3.0, you can conveniently record transactions specific to each GSTIN. Tally will automatically populate the transaction details in the respective GST returns and reports, streamlining the process for you. Additionally, you have the flexibility to create separate voucher types for each GSTIN or use a common voucher type, depending on your preference. TallyPrime 3.0 simplifies GST compliance and enables you to focus on your business growth without worrying about the intricacies of GST transactions.

Tag vouchers to specific GSTINs

With the latest TallyPrime 3.0 update, the process of recording transactions related to multiple GSTINs has been significantly streamlined. Now, users can tag voucher types to specific GSTINs, offering a faster and more efficient way to record data. This feature provides the capability to assign a particular GSTIN to a specific voucher type, such as sales invoices or purchase orders. Consequently, all transactions of that type will automatically be associated with the corresponding GSTIN, eliminating the need for manual selection and reducing the likelihood of errors in record-keeping.

Consider a scenario where a business owns multiple warehouses, each registered under a different GSTIN. In the past, recording sales invoices for each warehouse required manual selection of the appropriate GSTIN, posing a time-consuming and error-prone task. However, with TallyPrime 3.0, users can now tag the sales invoice voucher type to each specific GSTIN for every warehouse, streamlining the recording process and enhancing accuracy in GST compliance.

Create voucher series

TallyPrime 3.0 introduces the ability to create voucher series for distinct tax units, preventing the mix-up of vouchers. Users can set up unique series for various tax units like branches or divisions, each with its own numbering system. This feature enhances transaction tracking and ensures organized and accurate record-keeping, offering businesses greater control over their financial management across different units.

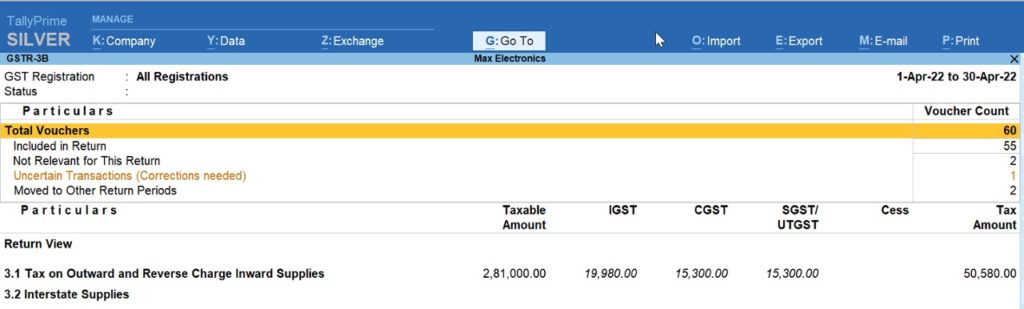

Combined Return and Reports view

TallyPrime 3.0 introduces a Combined Return and Reports view, streamlining the process for businesses to assess their GST compliance status comprehensively. This feature enables users to view GST returns and reports seamlessly on a single screen, eliminating the need to navigate between different modules. This integrated view facilitates easy comparison of data, helping identify discrepancies or errors efficiently. Users can also drill down into detailed reports to gain a more granular understanding of their GST compliance status.

Track GST return activities

n the latest TallyPrime update, tracking GST returns is faster than ever, regardless of data size. The instant opening of GST return reports not only saves time but also introduces new features like amendment and transaction effective date tracking. Additionally, the software allows monitoring of post-reconciliation modifications, ensuring transparency. With GSTR-2B reconciliation, businesses can maintain precise Input Tax Credit in GSTR-3B, aligning seamlessly with the portal’s auto-drafted GSTR-3B. TallyPrime combines speed and functionality for a swift and accurate GST compliance experience.

Read More About This